Fortitude Financial Group Can Be Fun For Anyone

Fortitude Financial Group Can Be Fun For Anyone

Blog Article

Indicators on Fortitude Financial Group You Should Know

Table of Contents9 Easy Facts About Fortitude Financial Group ExplainedNot known Incorrect Statements About Fortitude Financial Group Fortitude Financial Group Fundamentals ExplainedFortitude Financial Group - The Facts

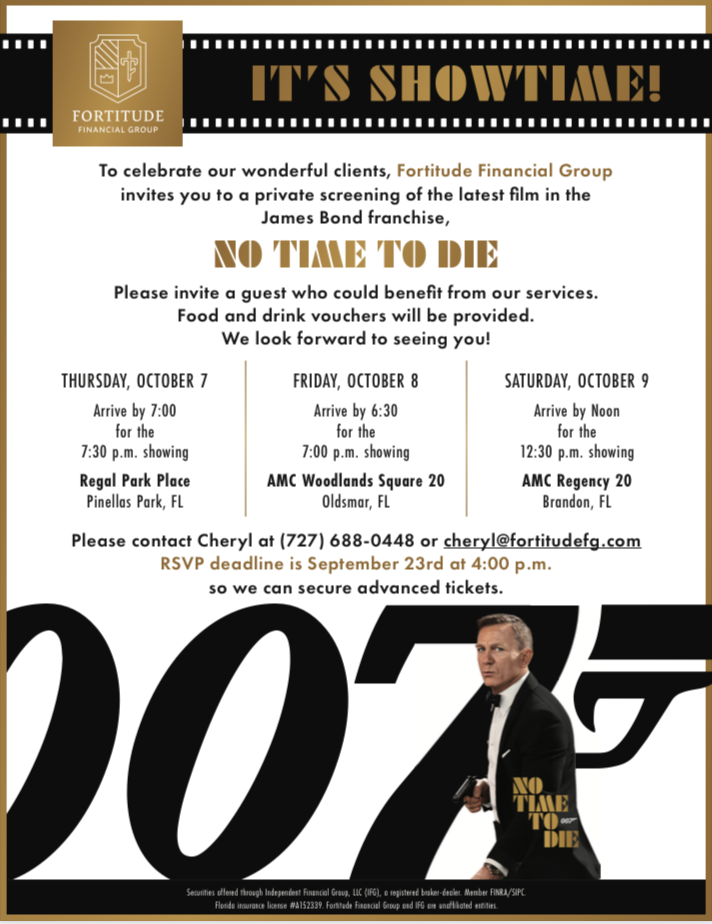

With the right strategy in position, your cash can go further to help the organizations whose missions are lined up with your values. A financial expert can assist you define your charitable providing goals and include them right into your financial strategy. They can likewise advise you in suitable ways to optimize your offering and tax deductions.If your service is a collaboration, you will certainly want to experience the sequence preparation procedure together - Financial Advisor in St. Petersburg. An economic expert can aid you and your partners comprehend the essential elements in organization sequence preparation, figure out the worth of the service, produce investor contracts, develop a settlement framework for successors, rundown shift options, and far more

The trick is locating the ideal financial expert for your circumstance; you may finish up engaging various advisors at various stages of your life. Try calling your monetary organization for recommendations.

Your next action is to talk with a qualified, licensed professional who can give suggestions customized to your specific conditions. Nothing in this short article, neither in any kind of associated resources, need to be understood as monetary or lawful advice. While we have made great belief initiatives to make certain that the information offered was right as of the date the material was prepared, we are not able to assure that it remains precise today.

The 20-Second Trick For Fortitude Financial Group

Financial experts help you make decisions about what to do with your cash. Let's take a better look at what specifically a monetary advisor does.

Advisors use their knowledge and know-how to create tailored economic strategies that intend to accomplish the economic goals of clients (https://fl-saint-petersburg.cataloxy.us/firms/www.fortitudefg.com.htm). These strategies consist of not only investments however likewise savings, budget plan, insurance coverage, and tax obligation strategies. Advisors further sign in with their clients on a regular basis to re-evaluate their present scenario and plan as necessary

The 7-Second Trick For Fortitude Financial Group

Let's state you intend to retire in twenty years or send your youngster to an exclusive college in 10 years. To complete your objectives, you may require a proficient specialist with the right licenses to help make these strategies a truth; this is where an economic expert comes in (Investment Planners in St. Petersburg, Florida). Together, you and your advisor will certainly cover several subjects, including the quantity of money you should conserve, the sorts of accounts you need, the sort of insurance you should have (including lasting treatment, term life, handicap, etc), and estate and tax obligation planning.

Financial experts give a selection of solutions to customers, whether that's why not check here offering reliable general financial investment guidance or aiding within a financial goal like buying an university education fund. Listed below, find a listing of the most typical services given by financial advisors.: A monetary consultant provides recommendations on financial investments that fit your style, objectives, and threat resistance, developing and adapting spending method as needed.: An economic advisor develops approaches to help you pay your debt and prevent debt in the future.: A monetary consultant offers ideas and techniques to produce budget plans that aid you meet your objectives in the short and the lengthy term.: Component of a budgeting strategy might consist of approaches that assist you pay for higher education.: Also, a monetary consultant creates a saving plan crafted to your specific requirements as you head right into retirement. https://gravatar.com/lovingsheepacf6c33ae1.: A financial expert assists you identify individuals or companies you intend to obtain your legacy after you pass away and produces a plan to execute your wishes.: A financial advisor provides you with the most effective lasting remedies and insurance choices that fit your budget.: When it comes to tax obligations, a monetary expert might aid you prepare income tax return, optimize tax obligation reductions so you obtain one of the most out of the system, schedule tax-loss harvesting safety sales, make certain the most effective use the capital gains tax prices, or plan to lessen tax obligations in retired life

On the questionnaire, you will also show future pensions and income sources, job retired life requires, and explain any type of long-lasting monetary commitments. In other words, you'll detail all existing and predicted financial investments, pension plans, gifts, and income sources. The investing element of the survey discuss even more subjective topics, such as your threat resistance and danger capability.

Getting The Fortitude Financial Group To Work

Now, you'll additionally allow your expert understand your investment choices also. The preliminary assessment may also consist of an assessment of various other monetary monitoring topics, such as insurance coverage issues and your tax obligation situation. The expert needs to be familiar with your existing estate plan, along with other experts on your preparation team, such as accounting professionals and legal representatives.

Report this page